You have worked hard, built up assets and property in the United States and now live overseas in Thailand. Or, you are a digital nomad and have a young family while travelling the globe. You know estate planning is a good idea but have been putting it off because it seems daunting and complicated. Or, you have an estate plan in place, but it’s been years since you dusted it off to make sure that it’s up to date.

Putting together a standard US living trust is more straightforward than you think. And, the benefits of having an estate plan in place will put your mind at ease with the knowledge you are taking care of your loved ones and your wishes will be carried out.

Who it’s for

Anyone who owns assets and real property in the United States and who now resides in Thailand and plans to live here full time or part of the year. It’s also for those who are digital nomads or working and living overseas in Thailand. And, it’s also important for those who have small children living here in Thailand.

Please Note: You don’t have to be a US citizen or even reside in the US to have a US living trust. If you own real estate or have US based financial accounts or other assets there, you are eligible to have a living trust under US law.

What are the benefits of a living trust

There are many benefits to having a living trust in place, not the least of which in giving you peace of mind and knowing that your loved ones are taken care of per your wishes.

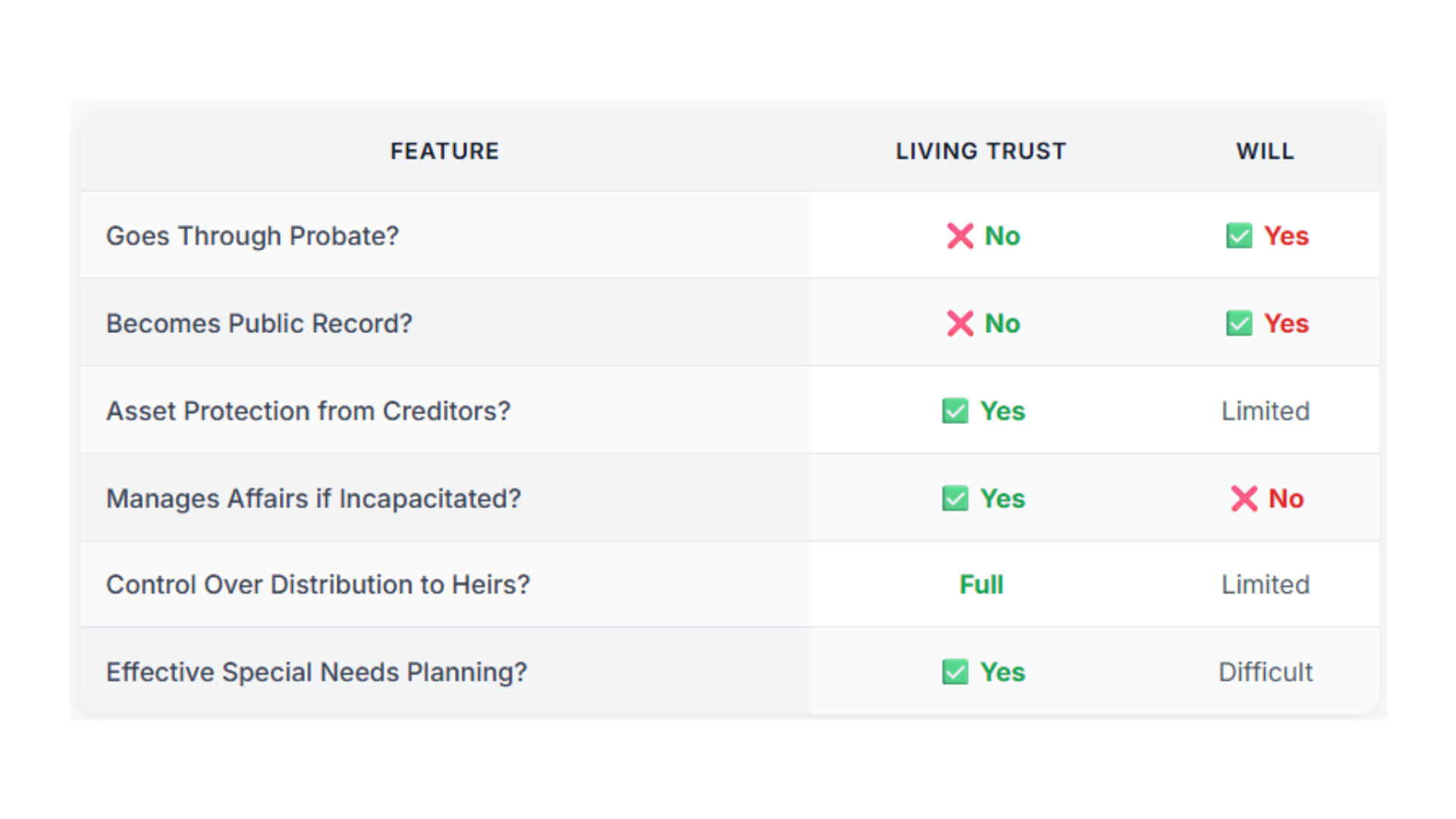

Here are 5 benefits of having a living trust in place:

- Avoid Probate and Keep it Private – You take the whole process out of the US court system which is time consuming and quite expensive. A living trust lets you directly transfer assets to your loved ones privately without hassle or delay.

- Asset Protection – A trust helps protect assets from legal battles or creditors of the beneficiary. In California, a well-structured revocable living trust can also help protect assets from Medi-Cal estate recovery.

- Full Management and Control – You appoint the trustee to manage your assets, while overseas, incapacitated or after your death. You can make changes to the trust document while you are alive. This can prevent the need for court-appointed conservators and guardianships.

- Estate Tax Planning – The trust can be a valuable tool to take advantage of tax exemptions and deductions.

- Planning for Minor Children and Special Needs Trust – Also, you can choose guardians and how and when funds will be distributed for your minor children. You may also set up a special needs trust for family members with disabilities, who struggle with addiction or are incarcerated, allowing a beneficiary to retain access to government benefits without jeopardizing their inheritance.

Please Note: In order to pass an inheritance to a disabled or incarcerated person without having those funds garnished by the institution, you will need to give full discretion and control to a trusted individual over those earmarked funds. The argument is that since the institutionalized person has no control of those funds, the government should not have a right to garnish them.

What Else Should I Consider

A complete and well-structured US estate plan includes a full range of legal instruments that is typically included in an estate service package. Below are the documents that you’ll want to have in place and why:

- Revocable Living Trust – This is the foundational document discussed above that should be crafted to your wishes and detail how you wish to pass on your assets at your death, retain control, while avoiding costly probate court proceedings.

- Trusts for a Non-US Citizen Spouse: For those whose spouse is a non-US citizen (e.g. Thai national), establishing specialized trusts may protect your spouse from potentially high estate and gift taxes.

- Medical Healthcare Directive: This important document allows you to choose your healthcare agent and clearly state your wishes for future medical care, and preferences regarding life-sustaining treatments, and end-of-life options (e.g. Do Not Resuscitate, organ donation, hospice care, etc.).

- Durable Power of Attorney: While you are overseas or if you are incapacitated, this document allows you to appoint trusted individuals to make financial decisions (e.g. payment to utilities companies, banking, real estate transactions, social security, etc.) on your behalf in the US.

- Guardianship Designation for Minor Children: For those with small children this will ensure that your children are cared for by the guardian of your choice.

- Last Will and Testament: Complimentary with the living trust, the last will and testament completes the estate plan to ensure your wishes are expressed and carried out for the benefit of your heirs.

- Assignment of Business Entity Interests/Shares: This document takes into consideration the succession plan for any business interests you may have (e.g. LLC, sole proprietorship, corporations, partnerships). By assigning business interests to the trust you allow for those shares to transfer smoothly as you choose and also allow for those you choose to take control of those interests upon your passing.

Please Note: You can make a silent assignment of your ownership interest in a wholly owned private company to your trust without changing stock certificates and making such transfers public. This will allow those interests to be managed by the trust but also maintain privacy.

FAQ

No. Our office (a 5 min walk from the US Embassy) is located in Bangkok, so you will be able to meet with our US lawyers (in person or via video call) in the same time-zone. The living trust and supporting documents may be notarized at the US Embassy in Bangkok. We can assist you in scheduling the notary appointment. After which, we can finish up the process and put together the binder at our office the same day.

No. Putting together a US estate plan is not as daunting as you think.

1) Call – Usually, a video call with our US estate planning lawyer will get most of your questions answered and a plan put in place to proceed.

2) Draft – We then draft and finalize the trust documents under US law and per your wishes.

3) Sign – We will walk you through each step and be able to have a finished estate plan ready to sign and execute here in Thailand at the US Embassy with a notarial officer.

Yes. You do not have to be a resident of California to be eligible for a living trust under California law. You may also hold out-of-state US property and assets under a California trust.

Free Consultation with US Estate Planning Lawyer

If you are interested to know more about setting up your estate plan, please reach out and schedule a free no obligation consultation with our US licensed estate planning lawyer.

You may also check out our estate planning services for more details of what we offer.